At CBHS we help you manage your health challenges. We believe in offering you the services, support and tools you need to live your best life.

Health and Wellness Programs are available to support eligible members towards a healthier lifestyle. Each Health and Wellness Program is subject to its own eligibility criteria.

Contact us for more information and to confirm your eligibility for a program.

Medicare Levy Surcharge

The Medicare Levy Surcharge (MLS) is an additional levy you have to pay if you don’t hold an appropriate level of Hospital cover and your income exceeds certain thresholds.

Proudly not-for-profit since 1951

As a not-for-profit, member-owned health fund, we exist solely to serve our members. What does this mean for you? We pay members more in benefits than the industry average - and we've done so for the last decade1. Because providing quality, affordable health cover is our priority, now and into the future.

Understanding the Medicare Levy Surcharge

The Medicare Levy Surcharge (MLS) encourages Australians in higher income brackets to take out and retain an appropriate level of Hospital cover.

High income earners (see the table below) who don’t have an appropriate level of Hospital cover have to pay an extra 1-1.5% tax, on top of the standard Medicare Levy of 2%. It applies to an individual and his or her dependents, including spouse or partner. For MLS purposes, a dependent is any child under 21, or any child or children who are full-time students and under 25.

Please note, a person who is covered as a dependent and aged over 21 on a family Hospital policy, who also earns over the MLS income threshold, is also liable to pay the MLS. To be exempt from the MLS, that person needs to take out a Hospital policy for themselves.

The MLS is paid in any period without an appropriate level of Hospital cover. Those who are exempt from the Medicare Levy don’t pay the MLS.

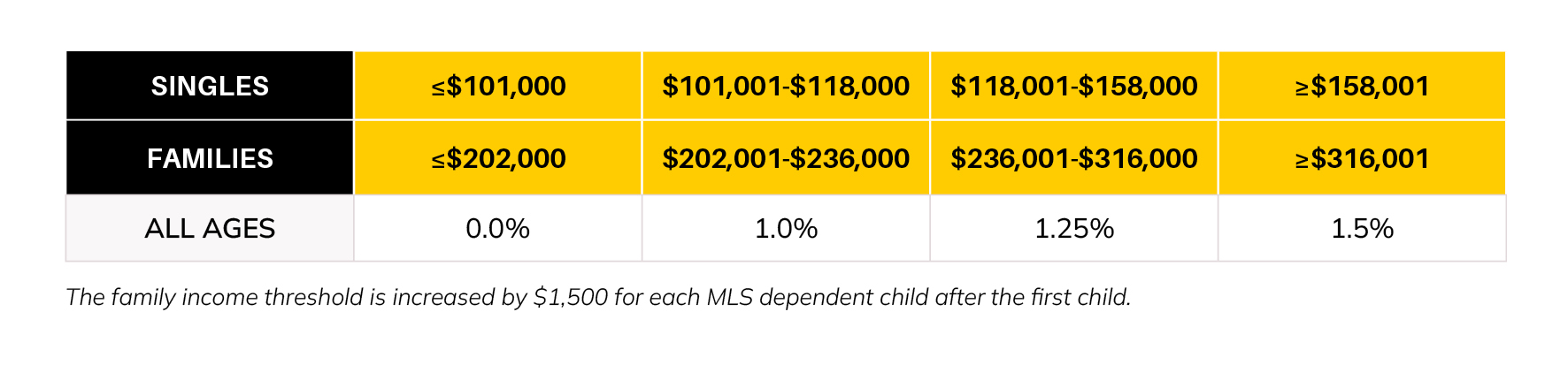

Income thresholds and surcharge levels

If you need to pay the MLS, it will be included with the Medicare Levy on your notice of assessment from the Australian Tax Office (ATO).

The table below outlines income thresholds and surcharges that apply from 1 July 2025. The income thresholds are indexed.

Single parents and couples (including de facto couples) are subject to family tiers. For families with children, the income thresholds are increased by $1,500 for each child after the first.

If as a couple or a single parent you have two or more children, the family income threshold is increased by $1,500 for every MLS dependent child after the first child. For example, if you have three dependent children, your family income threshold will increase by $3,000.

To work out your annual income for MLS purposes, you can refer to the ATO's Medicare Levy Surcharge Income Calculator.

You can avoid having to pay the MLS by choosing any of our Hospital cover products.

Suspension of membership

If you choose to suspend your Hospital cover for a short period, and we approve the suspension, this period may affect your MLS liability.